If you’ve ever stared at your Blue Cross Blue Shield Member ID Cards and wondered what all those numbers, acronyms, and boxes mean, you’re not alone. Insurance cards are packed with important details, but unless you work in medical billing, they can feel like another language.

In this guide, we’ll break down exactly how to read a Blue Cross Blue Shield card, what each section means, and how both patients and providers can avoid common mistakes. Whether you’re trying to understand your benefits or making sure claims get paid correctly, this step-by-step walkthrough will make it simple.

Why Reading Your BCBS Insurance Card Matters

Accurate card interpretation doesn’t just help patients; it’s a core part of revenue cycle management for practices. Many providers partner with outsourced medical billing services to ensure eligibility is verified correctly, co-pays are captured, and claims are submitted cleanly the first time.

Here’s why it matters:

- Accurate Billing: Every claim starts with the details on your BCBS card. A wrong member ID, group number, or missing prefix can lead to claim denials or delays

- Clear Cost Expectations: Your card often lists co-pays for primary care, specialists, or emergency visits. Understanding these upfront means fewer surprises at the doctor’s office.

- Network Clarity: Seeing whether your doctor or hospital is in-network or out-of-network is crucial. In-network providers typically mean lower costs and smoother billing.

- Avoiding Claim Rejections: Insurance companies are strict about accuracy. If the information from your BCBS card isn’t entered correctly, the claim may bounce back, and you could end up with the bill.

- Patient Eligibility Verification: Providers use the card to confirm that your coverage is active and to check details like deductibles and coinsurance. This step ensures services are authorized before they’re delivered.

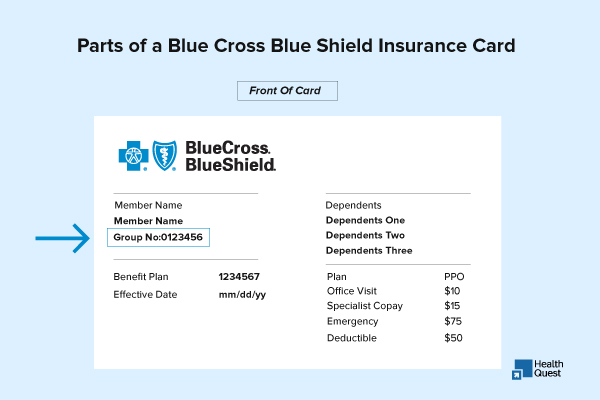

Parts of a Blue Cross Blue Shield Insurance Card

A Blue Cross Blue Shield (BCBS) insurance card may look simple, but each section carries important details for both patients and providers. Let’s walk through the key parts of the card, what they mean, and why they matter.

Blue Cross Blue Shield Member ID Cards Number

Every BCBS card starts with a Member ID number, usually printed at the top. This number is unique to each policyholder and is required for billing, claims, and checking eligibility. The first three letters, called the prefix, are especially important because they show which state or Blue Cross Blue Shield entity issued the plan.

Group Number

Next to the Member ID, you’ll usually see the Group Number. This ties the coverage to an employer or organization. For providers, it’s essential to enter the correct group number when submitting claims because it helps determine the exact benefits available under the plan. If this number is wrong or missing, claims may be rejected.

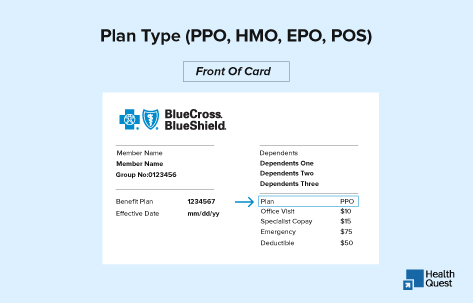

Plan Type (PPO, HMO, EPO, POS)

The upper-right corner of the card often displays the plan type. This small detail makes a big difference: PPO plans usually allow flexibility to see both in-network and out-of-network providers, HMOs require you to stay within a network and often need referrals. In contrast, EPO and POS plans are hybrids with their own referral and network rules. If you’re ever unsure about referrals or pre-authorizations, the safest step is to call the customer service number on the back of your card.

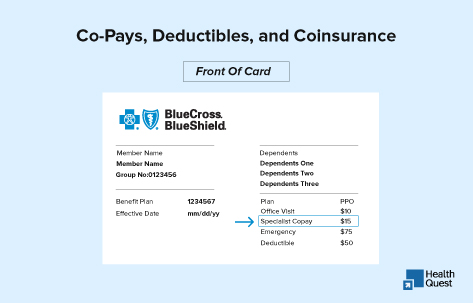

Co-Pays, Deductibles, and Coinsurance

Many BCBS cards also list common co-pays right on the front, for example, $25 for a primary care visit or $100 for an emergency room visit. Deductibles and coinsurance may or may not be printed, but they define how much you’ll have to pay before insurance starts covering services. Understanding these terms is key to knowing what your out-of-pocket costs will be.

Network Indicators (In-Network vs. Out-of-Network)

Some cards carry network symbols like the BlueCard® logo or the suitcase icon. These show whether your coverage extends outside your local area or includes nationwide providers. If your card doesn’t make it obvious, you can always confirm through the BCBS Provider Finder tool. Remember, going out-of-network usually means higher costs or even denied claims.

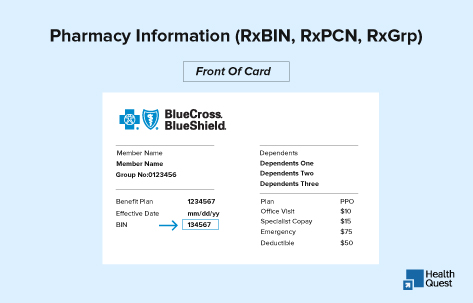

Pharmacy Information (RxBIN, RxPCN, RxGrp)

On the back of most BCBS cards, you’ll find pharmacy benefit details. Codes such as RxBIN, RxPCN, and RxGrp are what the pharmacy uses to process prescriptions correctly. In some cases, members may receive a separate card for pharmacy coverage, but if these codes are listed, the medical card should be enough at the pharmacy counter.

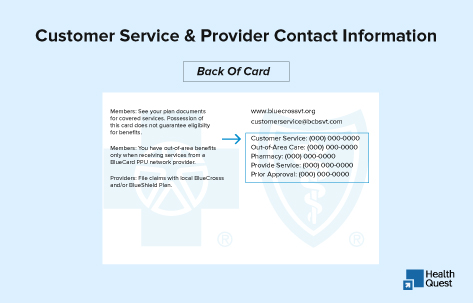

Customer Service & Provider Contact Information

Finally, the back of the card also lists customer service and provider contact numbers. These are important for prior authorization requests, eligibility verification, and claims questions. Whenever there’s uncertainty about referrals, benefits, or billing, calling these numbers is the most reliable way to get answers.

Read: How Much Does Blue Cross Blue Shield (BCBS) Reimburse for Therapy

How to Decode Acronyms on Your BCBS Insurance Card

There are some short-term acronyms you should know.

| Acronym / Term | Full Form | What It Means on Your Card |

|---|---|---|

| BCBS | Blue Cross Blue Shield | The insurance company provides your health coverage. |

| ID / Member ID | Identification Number | Unique number assigned to you; required for billing and claims. |

| Prefix | Member ID Prefix | First three letters of your ID (e.g., “ABC”); routes claims to the correct BCBS company. |

| Grp / Group # | Group Number | Identifies the employer or organization sponsoring your plan. |

| PPO | Preferred Provider Organization | Plan type allowing both in- and out-of-network care. |

| HMO | Health Maintenance Organization | Plan requiring referrals and usually only in-network care. |

| EPO | Exclusive Provider Organization | Hybrid plan with no out-of-network coverage (except emergencies). |

| POS | Point of Service | Hybrid plan with both HMO and PPO features. |

| PCP | Primary Care Provider | The main doctor you choose for routine care (often listed on HMO cards). |

| RxBIN | Prescription Bank Identification Number | Tells the pharmacy which benefit manager to use. |

| RxPCN | Prescription Processor Control Number | Routes your pharmacy claims correctly. |

| RxGrp | Prescription Group Number | Identifies your specific pharmacy benefit plan. |

| Ded | Deductible | The amount you must pay out-of-pocket before insurance begins covering services. |

| Coins | Coinsurance | The percentage of the bill you pay after meeting your deductible. |

| OOP Max | Out-of-Pocket Maximum | The most you’ll pay in a year before insurance covers 100%. |

| ER | Emergency Room | Co-pay or benefit details for ER visits. |

| UC / UR | Urgent Care | Coverage or co-pay for urgent care visits. |

| BlueCard® | Blue Cross Blue Shield Nationwide Program | Logo/symbol showing access to providers outside your home state. |

| Cust Serv | Customer Service | Phone number for eligibility, claims, or pre-authorization help. |

| C | Clinic | Indicates coverage or services at a clinic. |

| CC | Convenience Care | Walk-in or convenience care clinic coverage. |

| D | Dental | General dental coverage. |

| DP | Dental Preferred | Preferred dental plan option. |

| DT | Dental Traditional | Traditional dental plan option. |

| DE | Dental EPR, PPT | Specific dental plan variations. |

| FAM | Family / Parent & Child | Coverage for family or parent-and-child plans. |

| IND | Individual | Coverage for an individual subscriber only. |

| Open Access | Open Access Plan | No referrals are required to see a specialist. |

| P | Primary Care | Coverage or co-pay for primary care visits. |

| PD | Pediatric Dental | Dental coverage specifically for children. |

| PV | Pediatric Vision | Vision coverage specifically for children. |

| P&C | Parent & Child | Coverage option for parent and child. |

| RX | Pharmacy | Prescription coverage. |

| S / SPEC | Specialist | Coverage for specialist visits. |

| S&S | Subscriber & Spouse | Plan covering subscriber and spouse. |

| V / VC | Vision | Vision coverage. |

| AV | Adult Vision | Vision coverage specifically for adults. |

| VU | BlueVision Plus | Additional BlueVision Plus vision benefits. |

How Providers Use the BCBS Card

For healthcare providers and billing staff, the Blue Cross Blue Shield (BCBS) insurance card is more than proof of coverage; it’s the starting point for accurate billing.

Front-office teams use it to verify eligibility and confirm if the patient owes a co-pay, deductible, or coinsurance. Billers depend on the member ID, prefix, and group number to make sure claims are routed to the right BCBS plan. Even small errors here can lead to claim denials or payment delays.

Providers also check network indicators on the card, such as PPO or BlueCard®, to know whether they’ll be reimbursed at in-network or out-of-network rates.

Common Blue Cross Blue Shield Card Mistakes Patients Make

Many patients overlook key details on their Blue Cross Blue Shield (BCBS) insurance card. Here are the most common slip-ups:

- Misreading the Member ID Prefix: Those first three letters are critical for routing claims. Missing or entering them wrong can cause rejections.

- Assuming Out-of-Network Coverage: A PPO or BlueCard® logo doesn’t guarantee nationwide coverage. Always confirm before booking.

- Ignoring Pharmacy Details: Not all BCBS cards combine medical and pharmacy benefits. If Rx codes (RxBIN, RxPCN, RxGrp) aren’t listed, you’ll need a separate card at the pharmacy.

Read: BCBS Credentialing & Enrollment: Essential Strategies for Healthcare Providers

Tips to Read Your BCBS Insurance Card Correctly

To make the most of your Blue Cross Blue Shield insurance card and avoid unexpected costs:

- Always check if your doctor or hospital is in-network.

- Call BCBS before big procedures to confirm pre-authorization or referral requirements.

- Keep both sides of your card handy; the front and back include crucial billing details.

Digital and Mobile Blue Cross Blue Shield Insurance Cards

Today, Blue Cross Blue Shield (BCBS) members don’t always have to rely on the plastic card in their wallet. Many plans now offer digital or mobile insurance cards, which can be accessed through the BCBS mobile app or the member portal.

These digital cards contain the same information as the physical card: member ID, group number, co-pays, Rx details, and customer service contacts, but they’re available right on your phone.

Benefits of Digital Insurance Cards:

- Always Accessible: No need to carry the physical card; open your app.

- Up-to-Date Info: If your coverage changes, the digital card updates automatically.

- Easy Sharing: Providers can scan or accept the digital version for billing and eligibility.