Are you looking for ways to upscale your healthcare revenue cycle management? This blog has covered all the processes that can regulate your revenue stream. Continue reading further if you want details on how to establish a solid position in the healthcare sector through RCM.

Furthermore, streamline your revenue cycle management with our medical billing services & RCM solutions. Maximize efficiency & revenue. Contact us today!

What Is Revenue Cycle Management in Healthcare?

Revenue cycle management in healthcare is a framework that oversees all the financial processes of healthcare organizations that manage their clinical and administrative operations. For this, you can monitor the collection and handling of your patient service revenue to assess the management of expenses and the inflow of profits.

Your medical revenue cycle management will be initiated when an appointment for your healthcare services is made. It ends with you finally collecting all due payments in agreement with the patient and their insurance provider.

Foundations of Revenue Cycle Management

The foundations of revenue cycle management are laid down with the entry of a new patient. The first step is to pre-register and schedule them for an appointment. Most of the inaccuracies and confusion occur in this step. You have to collect accurate information from your patients.

This collection can prevent billing errors in future billing steps. Those errors result in reimbursement delays and claims denials. They also make it harder for you to treat your patients.

What Does a Patient Intake Form Contain?

Hospitals need their patients to fill out a patient intake form at the preliminary stage. It covers:

- Health insurance coverage for patients

- In- or out-of-network healthcare providers

- Type of care and pre-authorizations from insurance companies

- Previous medical history of patients

These details are compiled with the patients’ demographic entries. These entries include their name, date of birth, and contact information. You can use this data to set up medical records. You should verify your patients’ insurance eligibility and coverage. It should be done before you provide your services. This way, you can avoid clerical errors and other potential issues.

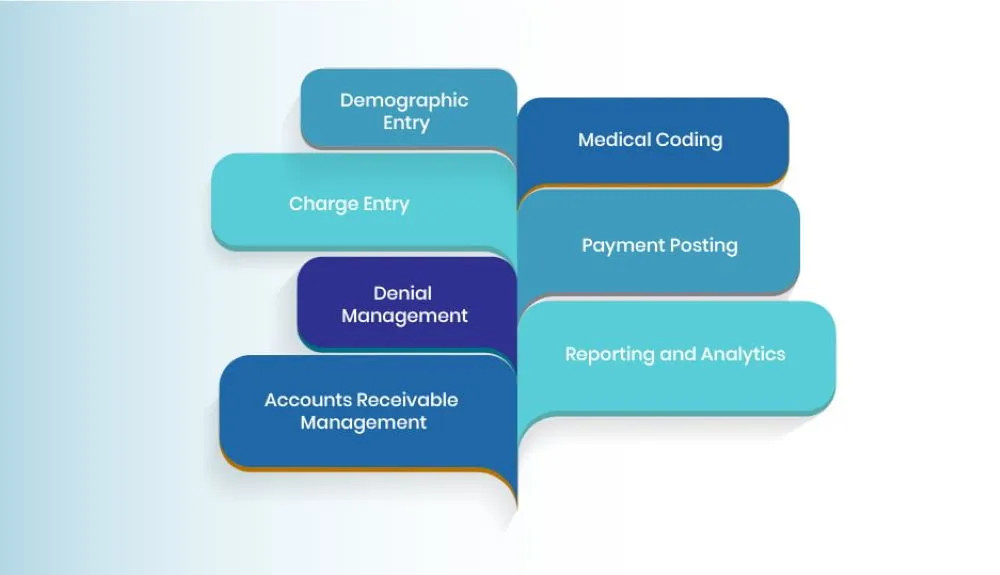

Processes Involved in Revenue Cycle Management

Revenue cycle management in healthcare involves processes like demographic entry, medical coding, charge entry, payment posting, denial management, reporting and analytics, and accounts receivable management. We will be analyzing them in detail below so that you can assess their roles in optimizing your revenue cycle management.

1. Demographic Entry

Healthcare organizations require demographic entries of patients to start the procedure, which records their financial details. Patients provide information about their insurance providers and coverage so that you can oversee reimbursements and billing in a timely and accurate manner.

You can discuss the insurance company, primary placeholder, policy number, and group number, among other details, with your patients to verify their insurance benefits and coverage. You can verify the information provided by contacting the relevant insurance companies and validating your patients’ coverage type and deductible status.

You can also confirm their eligibility and the inclusion of any pre-authorization or co-payment requirements for specific medical services. In the case of physical insurance cards, they can be scanned or photographed for documentation so that they can be referenced in the future.

2. Medical Coding

You can also convert your medical treatments and procedures into specific codes, which can be used to document accurate reimbursement and billing. This is a standardized health care revenue cycle management process to ensure that patients accurately pay only for the services they undergo. It is used to generate accurate medical bills that are sent to the relevant insurance companies for reimbursement.

You can use medical billing and revenue cycle management to file insurance claims for payment, streamline their processing, and prevent delays or claim denials. In this way, your patients or their insurance companies can accurately reimburse you for your medical services. Your revenue can be heavily optimized with medical coding if you properly document and code your services.

3. Charge Entry

You can also look into charge entry to manage your revenue cycle and record all the medical procedures and treatments provided to your patient. For this, you enter charges that also determine how insurance claims and medical bills are generated. In addition, reimbursement rules and fee schedules are considered as different payers can have different guidelines, which must be considered.

Charge entries also facilitate the management of accounts receivable, which also influences the revenue cycle of healthcare organizations. Charge issues and discrepancies can lead to delayed payments or claim denials. Therefore, you have to make charge entries carefully so that any rectifications or follow-ups are minimized.

4. Payment Posting

Payment posting is also important for you as it enables you to reconcile and record payments from patients or their insurance companies for your services. It also ensures a proper allocation and accurate accounting for the revenue generated. There is a remittance advice involved as well, commonly known as an Explanation of Benefits statement.

This statement contains information about medical services, payments, denials, adjustments, and other vital financial matters. You can allocate specific payments to specific patient accounts by applying relevant charges based on the statement. In this way, you can ensure all your medical services and their payments are accounted for.

5. Denial Management

The process of denial management analyzes, and resolves claim denials made by insurance companies whenever that payer either entirely or partially rejects your reimbursement claim. You can categorize denials based on the reason for rejection, which mostly comprises eligibility issues, non-covered services, and unfulfilled authorization requirements.

This process also involves a corrective action that you can develop as a solution by appealing the denial, providing the missing information, and asking the payer for clarification.

You can extrapolate your management by identifying patterns and trends in denials. Your expenditure will have to be diversified for this, which will negatively impact your revenue cycle. However, it is an important step for healthcare organizations so that they can improve their operations and prevent further denials.

Furthermore, streamline your revenue cycle with our expert denial management services. Reduce claim denials, increase payments, and improve patient satisfaction.

6. Reporting and Analytics

You may also have to invest in the collection and analysis of your financial data to interpret insights and ensure effective revenue cycle management. This enables you to derive implementations to improve that cycle and optimize your revenue stream. By collecting data, you can include important financial factors in your analysis, like payment posting, claims submission, and accounts receivable.

Certain key performance indicators, including net collection rate, denial rate, and average reimbursement time, may also have an impact on the performance of your revenue cycle. You can use them to identify patterns and trends in your revenue performance and claim denial rates and make informed predictions about outsourcing revenue cycle management.

By utilizing them, you can maximize your revenue by implementing certain performance-boosting measures, conducting audits, regulating guidelines, and stabilizing your financial position.

7. Accounts Receivable Management

Managing your accounts receivable is another process with which you can effectively streamline your revenue cycle by monitoring the outstanding payments to you. You have to track the overdue payments of insurance companies for the medical services you provide to your patients.

The purpose is to ensure that you are appropriately and timely compensated for your services, and you can fulfill it by regularly following up with your patients.

You can offer financial plans, send consistent reminders, and counsel your patients to derive the best way forward. Moreover, you can also inquire insurance companies about any denied insurance claims or overdue payments. Financial assistance can also be on the table for patients who do not have any viable insurance so that they can pay off their dues in a timely manner.

Importance of Revenue Cycle Management in Healthcare

1. Less Administrative Burden

You can minimize the administrative burden on yourself by implementing the processes above to prevent claim denials. Your staff can reduce their energy and time from appealing to those denials and utilize them effectively in patient care. By completing the tasks of your revenue cycle management, you can streamline the communication between your patients and administrative employees.

In this way, you and your patients can work together to execute operations like scheduling appointments, submitting claims, and completing documentation to establish a satisfactory experience.

2. Preventing Healthcare Fraud

Effective management of the revenue cycle can also prevent any unintentional or intentional fraud occurring as a result of low-quality medical treatments, improperly conducted services, or irrelevant treatments. Medical treatments and procedures can also be up coded, which means that patients or their insurance providers are charged with irrelevantly higher reimbursement.

You can optimize your revenue cycle management to ensure the distribution of accurate information between all parties involved and up-to-date regulation of healthcare policies.

3. Preventing Patient Fraud

Your patients can also be dishonest with you, and a secure revenue cycle management can help you in detecting their fraud. They may provide inaccurate insurance information and persuade you for certain medical services that they are ineligible for. With a rigorous demographic entry process, you can accurately verify insurance information and instantly detect any inaccuracies in them.

Medical identity theft is another issue for healthcare organizations as patients often claim to be someone else in order to receive ineligible services. You can also address this issue by conducting a strict verification process for your patients. You can utilize your revenue cycle to detect potential fraud in the pre-authorization phase of an entire procedure.

The 4 Key RCM Steps of Each Appointment

There are 4 key steps in revenue cycle management for every appointment. By accurately conducting them, you can improve your collections. You can also reduce payment delays and claim denials. Here’s how:

1. Verify Insurance Coverage and Benefits

You should confirm before your appointments how patients will pay for them. This step can get hectic sometimes. Some hospitals make mistakes and have to treat uncovered patients. It can be difficult to fix this mistake afterwards. So, you should try to prevent it before it becomes a problem. A reliable solution to insurance coverage verification is to increase your billing staff.

You can add remote workers. Your front desk may be hardworking and well-trained. But they may not always have the time to verify each patient on call. You can hire a dedicated remote staff member for this. They are more likely to always follow these verification procedures.

2. Pre-Authorizations

Medical procedures require pre-authorizations from insurance companies. Those companies authorize the coverage of those procedures. You should ensure that you have the proper pre-authorization. The challenge is consistency as medical billing is a busy process. An uncompensated appointment or an empty slot in your schedule is bad news. Pre-authorizations ensure that these issues are avoided.

3. Co-Payments Collection System

Hospitals also have to collect copayments from their patients. You must be considerate with your patients. At the same time, your practice should also receive timely payments. For this, you can educate and empower your patients through a system. The system should create appropriate financial policies for them.

Your staff should also be trained enough to accurately collect payments. You can record the payment information of your patients as well. All these features need appropriate technology to facilitate payments. You need to provide different payment methods while avoiding issues.

4. Clinical Documentation

This step is important for the entire billing process. Managing electronic health records can get boring even if it is simple. You can look into hiring scribes for assistance with those documents. Those scribes pay for themselves as they enable you to see more patients.

You can even ensure that you receive full payments for each visit. Your workload is reduced as any documentation mistakes can be double-checked. Hospitals can also bill services at their appropriate rates. This is the final step before you submit your claims to insurance companies.

Key Reports to Review

You can review the reports of your billing services to identify potential issues. You must consider the following metrics from those reports:

1. Clean Claim Rate

Clean claim rate is the percentage of paid reimbursement claims after submitting them. There have to be no delays or rejections. A clean claim rate of around 90% to 95% is ideal for hospitals. You just have to improve your rate without any focus on the industry benchmarks.

2. Percentage of Paid Accounts Receivable

This metric should be as high as possible. Most hospitals receive around 70% of their accounts receivable after 60 days. You are unlikely to get paid if the time keeps on increasing.

3. Accounts Receivable Unpaid Over 120 Days

This metric should always decrease. Hospitals do not get paid for the most part of this metric. They are usually only able to collect about 40-50% of the claims over 120 days old. It is far better than the average percentage of 30%.

4. Ratio of Closed Claims Vs Overall Claims

You are most likely to receive full payments if you get paid at all. This metric can be easily calculated. It is also more useful than other relevant metrics.

Challenges in Revenue Cycle Management

Hospitals can encounter a lot of revenue cycle management challenges. Let’s cover some of the major ones in detail:

1. Collecting Timely Payments

Hospitals are struggling to get their payments soon after they provide services. Many hospitals consider it as their biggest challenge. They expect some of their patients to not pay fully for their services. It can be difficult to conduct billing operations smoothly if the payments are not received quickly.

2 Inefficient Revenue Cycle Management

Many hospitals are looking to improve their revenue cycle to better serve their patients. But some of them lack the necessary tools and resources to manage it properly. As a result, your billing staff spends too much on revenue cycle management. They are unable to focus on other billing processes.

3. Coding Errors

There are a lot of coding errors that can occur. Some of them are unbundling codes, upcoding, and unlisted codes without documentation. They put burden on the financial resources of hospitals. Many hospitals still rely on old-school approaches to manage revenue cycles. Those approaches lead to claim denials and rejections.

The Role of Electronic Health Records in RCM

Electronic medical records have a major role as documents are at the core of medical billing. More demands and less staff lead to coding concerns. You must reduce the billing errors to improve revenue cycle management. Pre-authorization errors lead to a significant portion of claim denials. Medical data entry needs full attention to accuracy.

There is room for computer-assisted coding as well. You can use it to automatically process medical records. It can also validate the data and predict its results. EHRs can get the staff time and resources optimized. This is only applied for the tasks that need them. So, you can follow up with the patients and insurance companies.

In-House Vs Outsourced Revenue Cycle Management Services

In-house revenue cycle management services are managed by the billing staff of healthcare providers. They work inside the premises of those hospitals. Whereas you outsource revenue cycle management services to third-party medical billing companies. Let’s see how they stack up against each other:

In-House Services

With in-house medical billing, you know and trust the people who are conducting your billing processes. They are associated with you and know how you like running the process. It is also easy for you to track their performance. They are most likely to be in the same building as you. You can try new methods with them to benefit your RCM. However, in-house billing staff increases your costs in the form of salary and employee benefits.

You also have to purchase your own billing software and train them on it. You are also more dependent on them. There is always the risk of delayed processes if there is an emergency. Your staff can also demand extended leave which can add to the delay.

Outsourced Services

Outsourced revenue cycle management means you do not have to invest time in hiring. You do not have to train a staff and pay for their salaries. The outsourcing company takes care of all your RCM-related needs. It also professionally manages all the billing processes. Their staff is most likely to have billing experts.

They can handle the processes with accuracy and efficiency. However, you have less control over your own billing processes. Since the ones managing them are working somewhere else, you cannot monitor them effectively.

They have their own methods that will follow industry standards. But they may not always align with yours. The payment method of outsourcing companies also varies. For example, a fixed fee can be annulled by a percentage of your earnings.

The Bottom Line

By implementing these processes, you can streamline your revenue cycle management by maximizing profits and cutting down on expenditures. This highlights its importance for effectively running healthcare organizations and maintaining a healthy relationship with patients.

The certified revenue cycle professionals at Health Quest Billing can expertly address your queries about your revenue cycle management. Join us today and be a part of an amazing initiative where you can take your healthcare organization to the next level.

15 mint read

15 mint read